Why Did Zillow Offers Fail So Hard?

After buying over 13,000 homes in the last six months, Zillow has abruptly decided to shut Zillow Offers, their ibuying arm, down for good. $550 million is their expected loss, along with the firing of 1 in 4 Zillow employees.

The results are in, folks. Turns out using billions of dollars and a fancy computer algorithm to flip houses during a global pandemic is not a smart idea. Realtors and their fax machines finally get their "I told you so" moment.

It's not a good look for Zillow. The company hopped on the ibuying train, along with competitors like OpenDoor, a few years ago. Since then, they've picked up thousands of homes across the U.S. at what a computer they thought were prices that would give them a good profit margin when it came time to sell them.

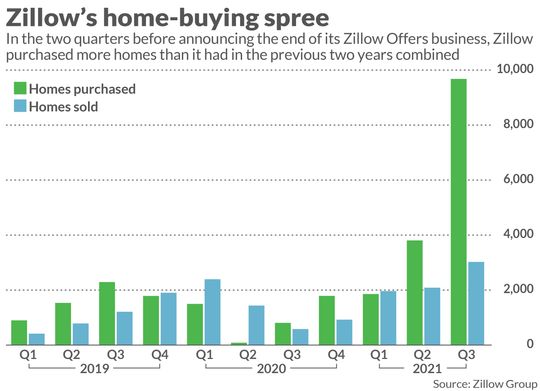

But now, after buying over 13,000 homes in the last six months, they have abruptly decided to shut the entire thing down. $550 million is their expected loss, along with the firing of 1 in 4 Zillow employees.

The CEO of Zillow was quick to say it has to do with "market uncertainty" and "balance-sheet volatility", which in corporate-speak means, we f***ed up.

Some analysts within the company have quietly revealed that the algorithms Zillow has been using all along are inherently bad, and that two-thirds of the homes they bought are underwater (and presumably were on the day they closed escrow).

That would explain why, in Q3 of this year, they were only able to sell 30% of the homes in their supply, compared to new acquisitions.

The company is now in full CYA mode, trying to offload about 7,000 homes to recoup some of the money they spent.

What effect will Zillow Offers collapse have on the housing market?

People smarter than us will likely speculate on why the ibuying experiment at Zillow crumbled. It's not hard to comprehend. They trained their models under normal circumstances. And the circumstances for the last 18 months have been anything but normal. Buyers and sellers have not been acting rationally; market indices have not been usable under a global economy in crisis mode.

The short-term effects of a selloff of 7,000 homes will most likely not be the thing that forces a correction in the housing market. Remember, buyers and sellers are not acting rationally still.

What stands out to us is the fact that Zillow thinks it's MORE PROFITABLE to take a half billion dollar loss, than to wait even six months to see if the market continues to push upwards. If this is indeed (and we are reading heavily between the lines here) an early move to get out before things get bad, then we should all take pause.

Original article from marketwatch.com, archived: http://archive.today/kZ9SB