Blockchain Affordable Housing Solution

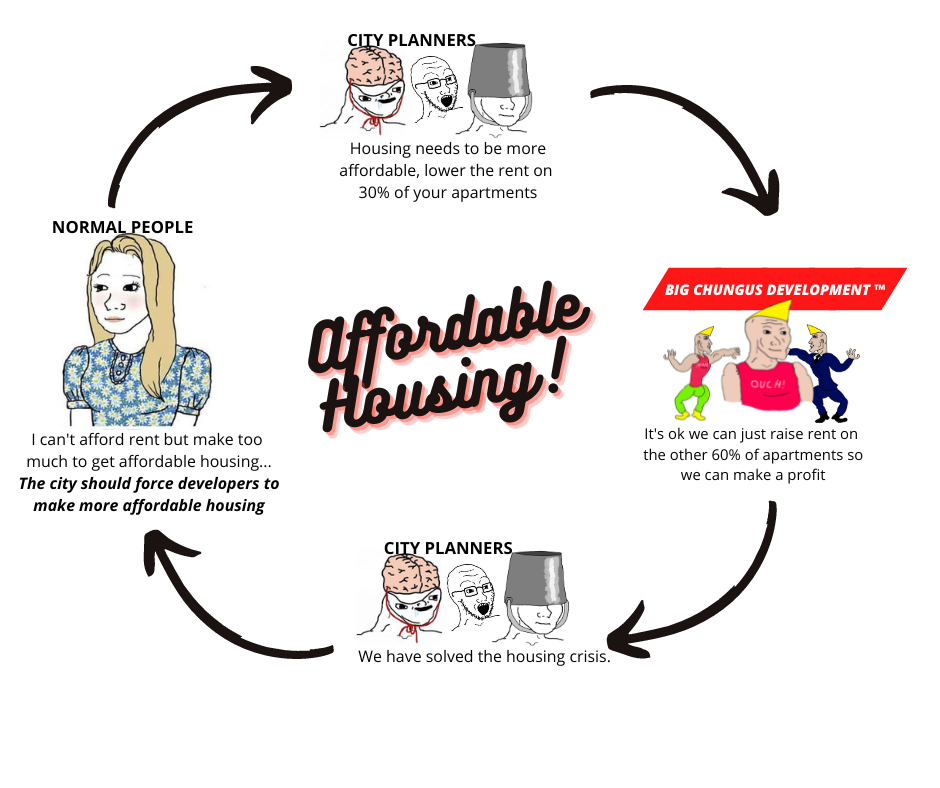

So What's the Problem?

Affordable housing is a crisis across the globe, in both developing and developed nations. There are quite a few things you could point to as the main cause or issue to "solve" this.

But solutions are rarely scalable...

What works in Africa may (definitely) not work in, say, New York. Of course somebody should solve housing crises in developing nations, but I have to stick with the things I know the most about, and that's real estate finance specifically in North America.

Making housing that is affordable is hard. Incentives are wildly misaligned between builders and governments, especially capitalistic ones.

My Solution

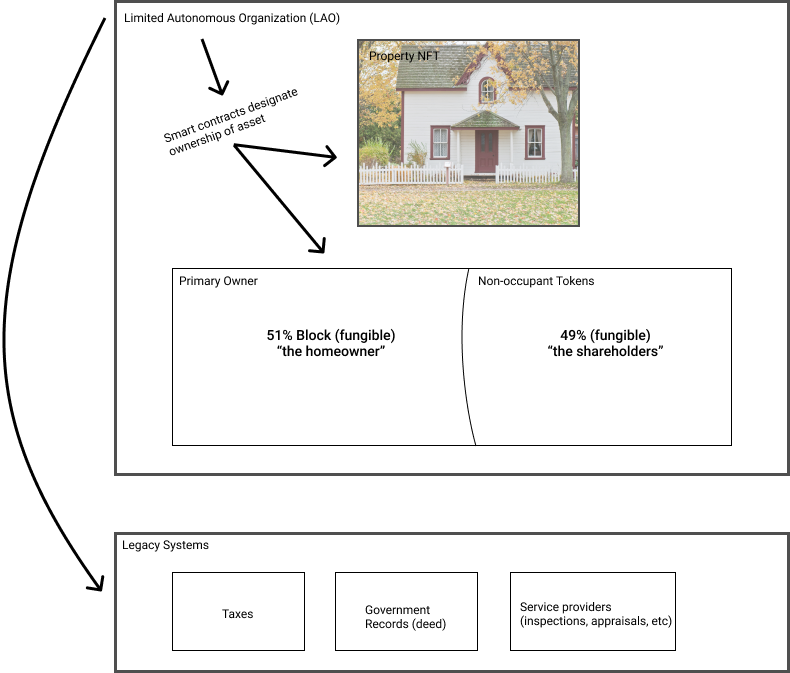

I want to enable builders and developers to efficiently tokenize their housing units using a combination of a non-fungible token (to represent the asset) and fungible native tokens to represent ownership, all governed by a limited autonomous organization (LAO). More on that in a moment...

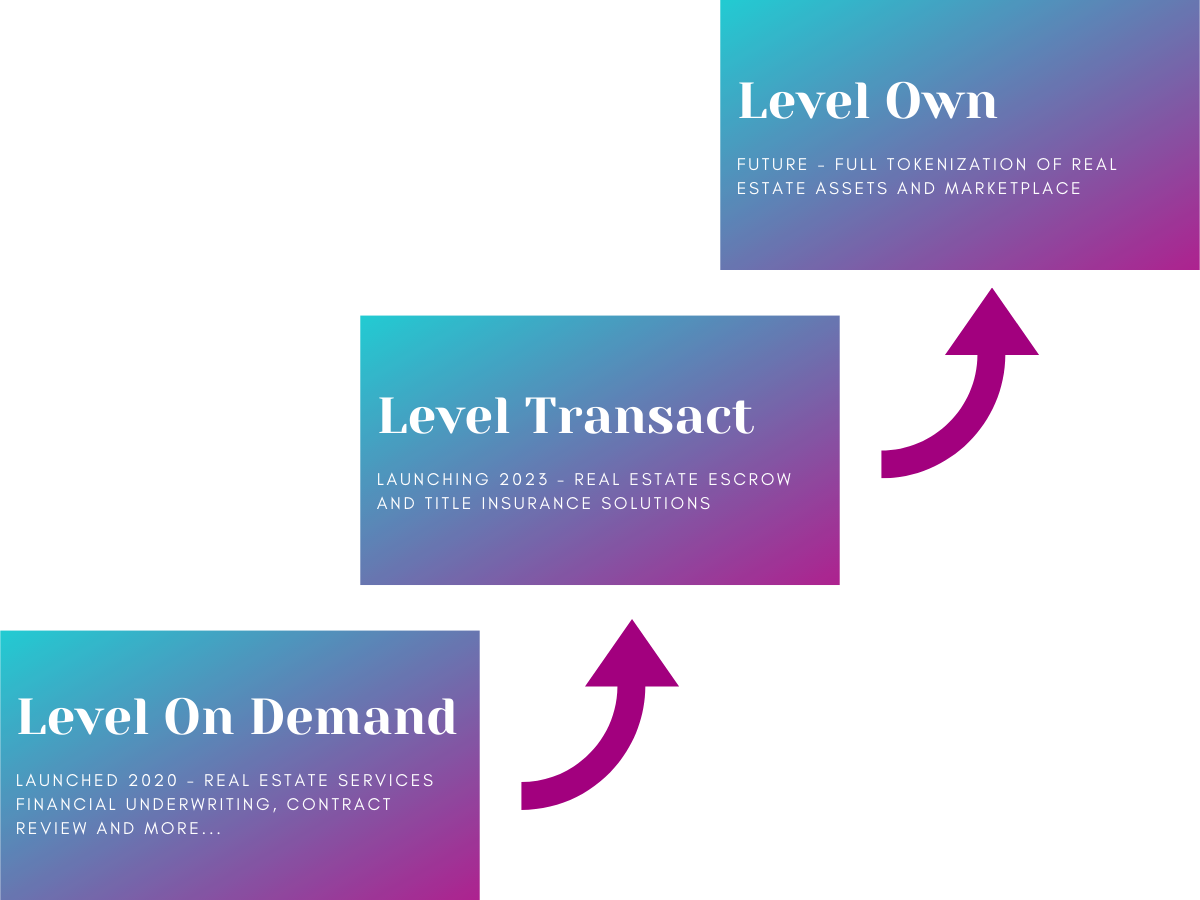

The model I want to build on Cardano is not a new venture for me. It's what I've already been building, and hope to accelerate rapidly. The plan has always been to create an escrow system on Cardano for real estate transactions, with full tokenization of assets coming "post voltaire".

You can read more on the escrow solution currently in development here

So what exactly is going to be developed on-chain?

Here's a simple visual to represent how it works:

The LAO is essentially a U.S. based LLC that is created for each individual unit and governed not by a paper operating agreement, but a combination of smart contracts. A single NFT will be minted and tied in perpetuity to each unique housing unit and will in turn be owned by the LAO.

100,000 fungible (but unique to each unit) tokens will be minted to represent ownership of each unit. 51,000 (or 51%) of these will forever be a single "block" which cannot be divided. Whoever owns this ownership block is the person/entity who will have the exclusive right to occupy the unit.

In the governments view, the LAO is responsible for paying taxes, not an individual, so a separate contract will ensure money is paid in/out for taxes from the 51% owner.

The remaining 49,000 (49%) of the fungible ownership tokens will be available to be bought/sold on the open market. This will look like a semi-private marketplace initially, with a fully public marketplace opened after proper Q/A so anyone (legally allowed) can buy and sell tokens.

What's so cool about all this?

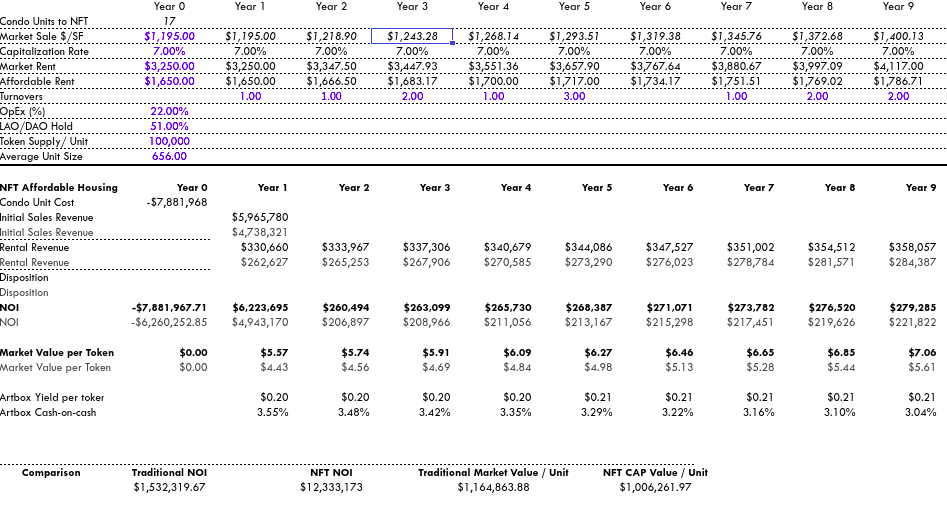

- Cost of ownership is reduced by 49% (ability to rent/let at a 49% reduction too!)

- Incentives to bring property information on-chain to increase value (repairs, improvements and other qualitative data)

- Market value no longer directly tied to fiat/legacy method of valuation

- A more fair and open marketplace for investment in real estate by all

What's the cost to reach MVP? 120k

The short answer: Lawyers.

The longer answer? Still lawyers but also a few other things.

- Legal and financial framework creation, lobbying and filings will eat about 70k (58%) of the requested 120k in funds

- Finishing the various smart contracts and escrow solutions I have already started in plutus/marlowe is another 35k (29%)

- The remaining 15k (12.5%) will go to web/mobile app development to provide a sleek gui for everyone (think yoroi but on real estate steroids)

Metrics and Milestones

Remember that diagram up above with arrows and boxes showing NFT's and fungible ownership tokens and a LAO? All the smart contracts related to that will be functional by the 3 month mark, so we can begin the harder work of stress-testing and QA

In tandem with development, all our legacy/off-chain legal contracts, agreements and how they will integrate with our smart contracts will be ready at 6 months (properly qa'ed smart contracts and web/mobile gui's will be 90% ready too)

In the run up to the 12 month mark, bugs will get squished and I will implement this in my development in Toronto, along with a few hand-selected developments by other like-minded builders in markets like New York, LA and SF to really prove our use case.

WHY NOW?

My developer friends at [insert company name] are faced with strict requirements to set aside some otherwise profitable units to be "affordable rentals". Under the current system, there is no way to generate a profit on these affordable units, and they are just written off as a sunk cost (money that is spent and cannot be recovered). I have incorporated my Blockchain Affordable Housing model in our projections and we plan to implement this in a real world scenario as soon as its ready.

I know what can and cannot be done

I know the regulatory hurdles that others don't. I know what is possible. My over a decade of experience fundraising for real estate projects in the U.S. means I understand how to properly structure this proposal to adhere to existing regulations.

If we have to file with the SEC, do we go for Reg. A, Reg. A+, or Reg. D?

Can we claim exemption and just do a private placement for the unregistered tokens?

Will our secondary market require annual and quarterly filings?

These are all IMPORTANT questions I have considered and have solutions for. Many other real estate projects with similar visions don't address these issues and cannot legally deliver what they envision

5. My Credentials

I myself am a real estate developer/builder of large scale projects. My RE finance and legal career of 12 years has included commercial brokerage, RE tech development and international consulting. My days now are mostly spent running Level On Demand.

I have been an active participant in the blockchain space for years. One of my contributions in the past was a grant proposal about using stakepools for fundraising; you can take a look at the original documentation here. The mechanics and economics of my thesis have since been adopted (almost exactly as I proposed) first by SundaeSwap and then more notably by MELD to raise millions in funding.

Fun fact - I used to run a book club 👇

side note about book club, it you ever need some inspiration for books to read or topics to research, check out the depository section!

... and finally, here's where you can find me:

- My linkedin

- I'm on discord: stephen#5990

- Telegram: @crispinscrispian

- Good ole email: stephen@leveltransact.com